Did the Music Business Just Kill the Vinyl Revival?

A few months ago, I wrote about returning to vinyl after giving up on it 34 years ago.

But I was shocked at what I encountered. Few of the albums I wanted were available in vinyl. Prices were outrageously high. The whole market seemed designed to discourage buyers.

I’d heard so many grand claims for the vinyl resurgence, but the reality was tremendously disappointing. And I was a late adopter—the revival had been going on for a decade, but record labels still didn’t have their act together.

In my case, I ended up buying vinyl albums, but mostly used ones. I simply couldn’t find new pressings of the records I wanted. This was fine for me, but lousy for musicians and labels—who make no money on the sale of a secondhand vinyl album.

I have some experience in these matters—in my alternative career I worked with CEOs chasing after fast growth product categories. I know how they handle these situations. But, really, it’s no mystery. The strategies you use in this kind of business are very straightforward:

(1) You add manufacturing capacity aggressively—to make sure you have enough product to fuel growth.

(2) You bring down costs by getting scale advantages. But this only happens because unit costs drop as volume increases. So the single biggest goal is to grow sales as hard and fast as possible.

(3) You constantly reduce prices to keep demand building. In some cases, you even set prices below your costs to accelerate growth rates. When I originally saw companies do this I was skeptical—how can you make profits if you sell below your costs? But I soon learned that you eventually got a huge payback.

(4) You keep expanding the product line, so that you constantly have something new and exciting to sell to every potential buyer.

(5) You invest in R&D so that you eventually have a next generation technology to keep the growth going over the long haul.

None of this is easy to do, but it isn’t impossible. It just takes investment, focus, management commitment, and hard work. And later you reap the benefits. You turn a small business into a huge one, and enjoy a big payday.

“In the year 2023, even bowling alleys, bordellos, and bookies are more tech savvy than the major record labels.”

The record labels could have done that with vinyl. It was taking off—unit sales doubled in just 5 years. And these sales were insanely profitable, because much of the demand was for old music. So labels didn’t even have to pay to sign artists, and cover the costs of recording sessions. The music was already there, with the fixed costs amortized long ago.

They just had to press the bloody album and ship it to the store. How hard is that?

But what did the music industry do?

They want easy money, so they kept prices extremely high. That was bizarre because their R&D and catalog acquisition costs were essentially zero, and they could have priced vinyl aggressively. Instead they treated vinyl as a luxury product, even as they dreamed of it also becoming a mass market option. But you can’t do both without a careful market segmentation strategy—which the labels never even started thinking about.

They love hype, so they focused on high visibility vinyl reissues, which look good in press releases, but couldn’t be bothered to make back catalog albums available. After a decade of the vinyl revival, they still hadn’t taken even basic steps in offering a wide product line.

This is a lazy strategy—and the exact opposite of what they should have done. And the results are, of course, predictable.

Here’s what I predicted in my article 11 months ago.

The level of greed is off the charts. Because it’s so hard to make money in music nowadays, the labels have decided to squeeze as much cash as they can from vinyl fans. This is one area where Spotify and Apple don’t call the shots, so why not charge twenty dollars for vinyl? Or maybe thirty dollars is better. Hell, let’s ask for forty, and see who will buy?

In other words, a technology that is 70 years old—and in which labels have invested almost zero additional dollars—is priced as if it’s a hot new innovation requiring billions of dollars in startup capital. This is like taking your old shoes, and trying to sell them for twenty times what you paid for them.

In a market where retro is hot, you might get away with this—at least for a short time. Some of my readers will probably respond: Well, if Taylor Swift fans are willing to pay forty bucks, it’s a perfectly fair price. That may be true, but it’s still a stupid price—because the vinyl revival won’t become a mass market phenomenon at these prices. I’ve spent a lot of time over the years studying the economics of pricing, and will tell you with absolute confidence that what record labels are doing right now will eventually be taught in business schools as a case study in mistaken priorities.

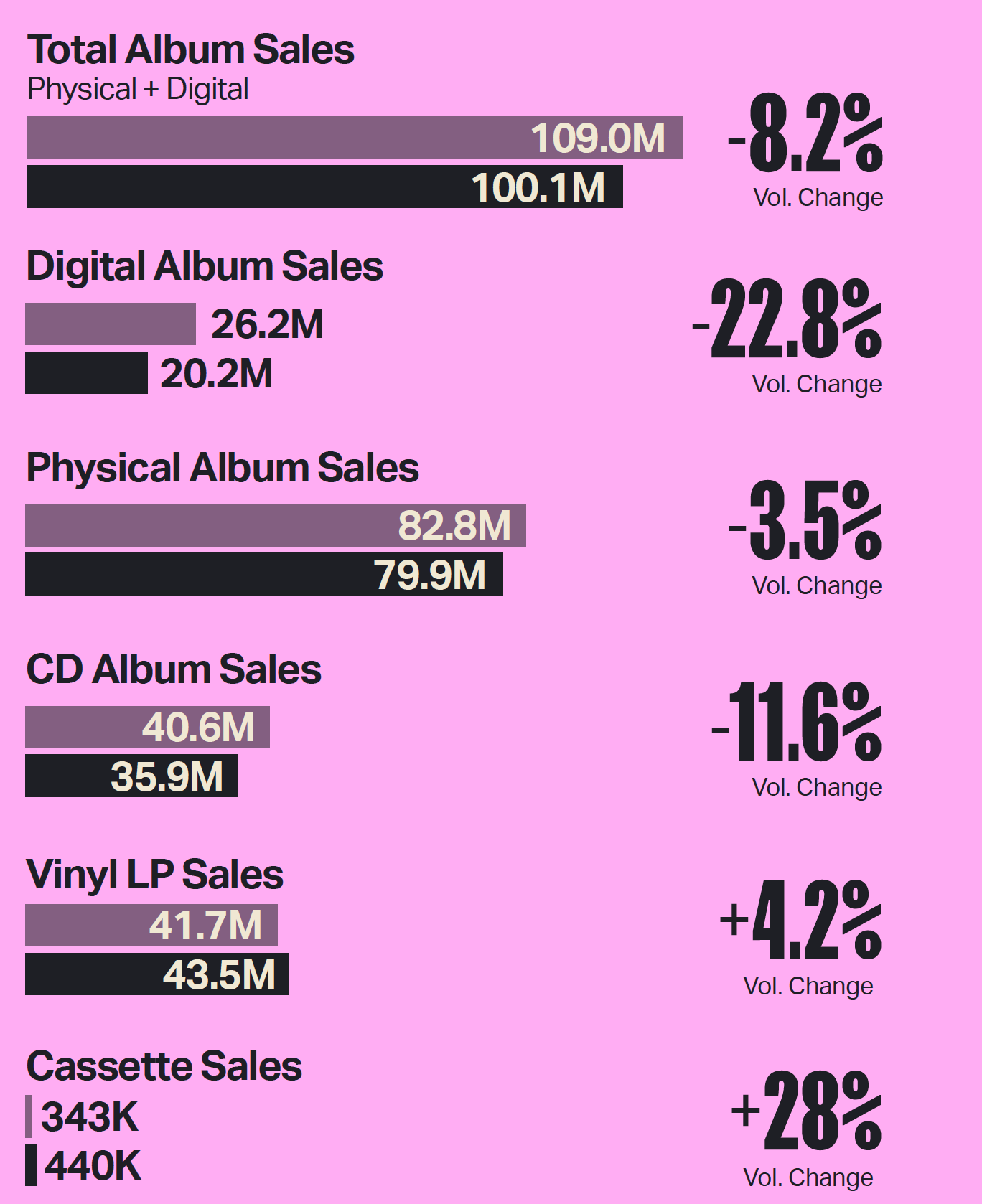

And now all this is starting to happen. Last week Luminate released its end-of-year figures for the music market.

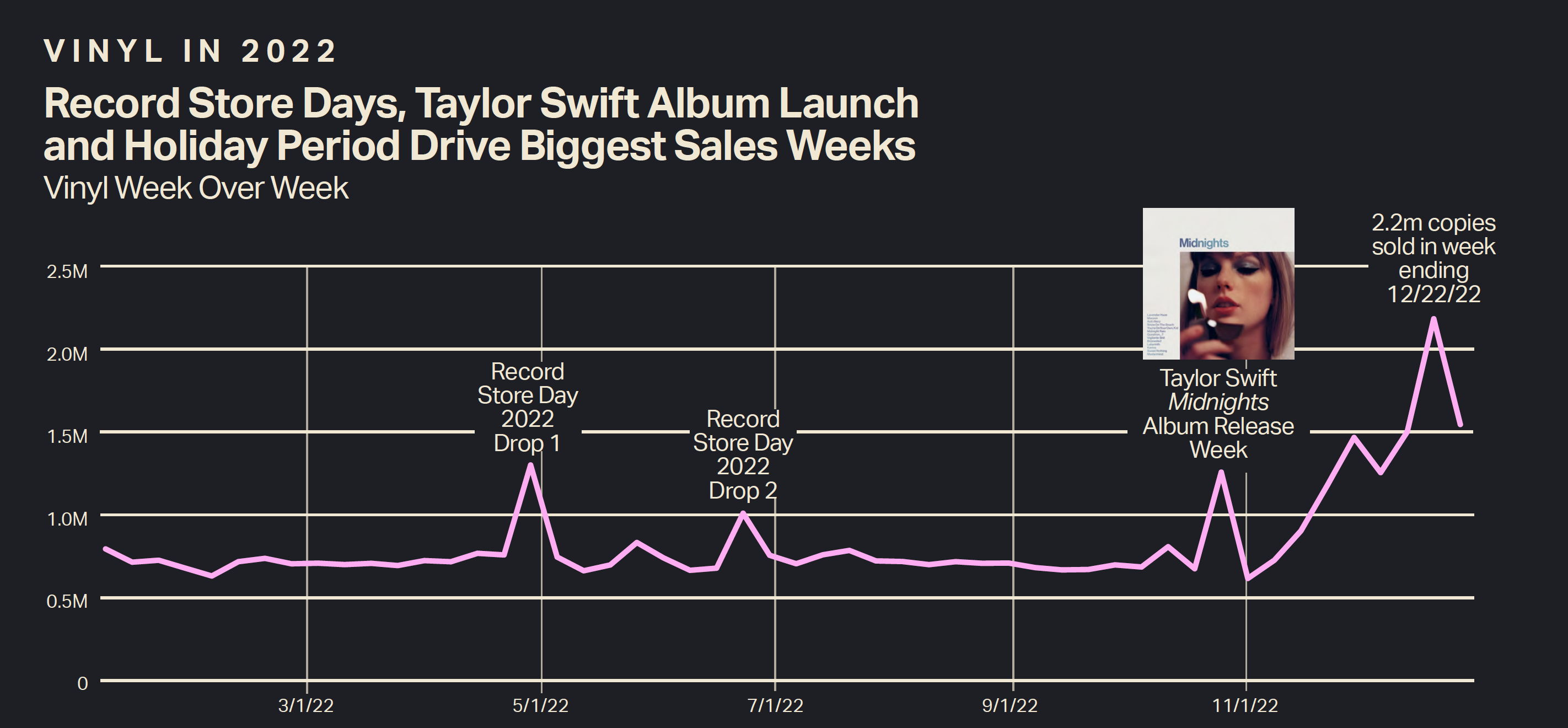

Despite all the hype, vinyl album unit sales only grew 4%. I’ve heard some people praising this in silly news stories about the continued growth in vinyl.

But those numbers are a HUGE disappointment.

Just a year ago, the industry was bragging about a vinyl market that had doubled in size in a single year. In just 12 months, demand had increased from 21.4 to 41.7 million units.

But then in 2022, the growth rate collapsed from 95% to 4%. That’s not a slowdown—that’s slamming on the brakes right before you hit the brick wall.

Check out the trend line—which tells you immediately that the amazing growth spurt of the last few years is now over.

And if it wasn’t for Taylor Swift, the vinyl market would have actually declined in 2022. This one artist did more to support vinyl sales than the much hyped “Record Store Days.”

But here’s an even more ominous sign. Half of vinyl buyers don’t own a record player. They apparently bought the Taylor Swift album as a kind of memorabilia—something a little nicer than a band T-shirt.

This can’t

be a good thing for the record business. After all, how many records are you

going to buy if you don’t have a turntable? This is like trying to sell Teslas

as a status symbol to people who don’t drive.

Maybe some

brilliant minds at the major labels are already thinking ahead to the next

fad—the supposed cassette tape revival.

But those

folks are blowing smoke. Cassette sales are minuscule. Despite all the hype,

they are still below a half million units—roughly the streams The Weeknd gets

over a weekend.

Here’s the

bottom line on album sales in all formats (physical and digital). The tiny

growth in vinyl and cassettes isn’t even enough to compensate for the drop in

digital album purchases.

On an

aggregate level, consumers are simply not buying music. They prefer to stream

it for pennies rather than purchase it for dollars.

As these

figures make clear, vinyl has stalled out around the size of the moribund

compact disk market.

I guess it

could be worse—but it couldn’t be much worse. The music industry took its

fastest growing segment and killed it through greed and laziness.

If they had

followed the standard playbook for growth industries (outlined above), they

could have brought vinyl back as a mass market option. They might have easily

convinced 40-50 million consumers to buy a dozen vinyl albums per year. That

would create a total market more than 10 times as large as the current one.

In that

kind of world, musicians would benefit. Record stores would thrive. Fan loyalty

would increase. And record labels would have more cash for themselves and a

legitimate way of making money that doesn’t rely on Silicon Valley technocrats

and hostile streaming platforms.

In short, the

culture would be healthier.

Maybe this

can still happen. But once you blow an opportunity like this, you rarely get a

second chance.

For my

part, I have zero confidence in the people who made this mess in the first

place. Nothing will get fixed until they’re replaced by visionaries who can

actually lead the music business in the right direction.

Sometimes

those people emerge—as I recently reported with Barnes & Noble, where a new

leader at the top reversed course and fixed longstanding problems. And I know

that people like that exist in the music world. I’ve even met some of them—but

not in executive suite of any major label.

- Ted Gioia,

Honest-broker.com